Traveling has been expensive as inflation has caused everything from flights, hotels, and restaurants to go up 30% while a typical wage has increased just 2%.

Vacationing and traveling have been out of reach for many Americans who would have to pay tens of thousands of dollars to travel with multiple kids. In this blog, I want to share some of my travel hacks so you don't have to compromise on saving money and the memories you'll build on your next family vacation.

Trang and I enjoy traveling and have traveled to Europe in 2018, and several domestic trips in 2019. Even though it was just a few years ago, traveling was still a reasonable expense and nothing like it is today. Now it is not unreasonable to pay over a couple of thousand dollars to fly to Europe or pay a couple of hundred dollars for a mid-tier hotel.

Luckily there are strategies you can use to minimize your travel costs. The main method we use is by using credit card points. Some financial experts swear by only using a debit card in order to spend money that you actually have. I can understand this is good advice to some people, but to others who are disciplined and have good control of their personal finance, this is equivalent to just throwing money away.

For financially disciplined people who could use their credit cards and pay back the full balance each month, you should strictly be using credit cards in order to earn credit card points. With these points, you can reap significant savings on things like cash back, gift cards to restaurants, or paying for travel expenses.

Trang and I have full control of our budget each month and spend roughly 25% of our net income on purchases, so we have no issue fully paying the balance each month. We accumulate these points strictly to travel instead of taking advantage of everyday items like groceries or amazon purchases.

Recently, we took a trip to Los Angeles and stayed at the Waldorf Astoria in Monarch Beach for two nights with our parents. The cost of each room with fees would have cost us more than four thousand dollars, but we were able to use our points to stay for a couple of hundred dollars.

With the Hilton Surpass Credit Card, you can receive Hilton free night certificate for each $15,000 spent annually. So along with points and two certificates, we were able to stay in an upgraded room and receive vouchers for meals and drinks (also a perk of the credit card) for next to nothing. The value we receive from this card greatly exceeds the $95 annual credit card fee that we pay each year.

(we also paid $85 for a two-night stay at the Conrad Nashville over the summer)

You can objectively quantify the value of these points by dividing the cost by the points needed for redemption. For example, a $1000 hotel room at 95000 points means a redemption value of 0.01 versus a $250 hotel room at 50000 points would equal a value of only 0.005, half the value. No matter what type of points you receive, you can compare a good value by taking the cash cost divided by the points (flight cost/miles i.e.).

Another strategy for maximizing your points is by taking advantage of the bonus points when opening a new card. Amex, unfortunately, has a strict one-time bonus policy per user, but other credit cards like Chase allow you to receive bonus points once every four years.

Trang and I would both alternate opening a new Chase credit card by sharing the card with an authorized user. Then open it by the other person to receive bonus points every two years.

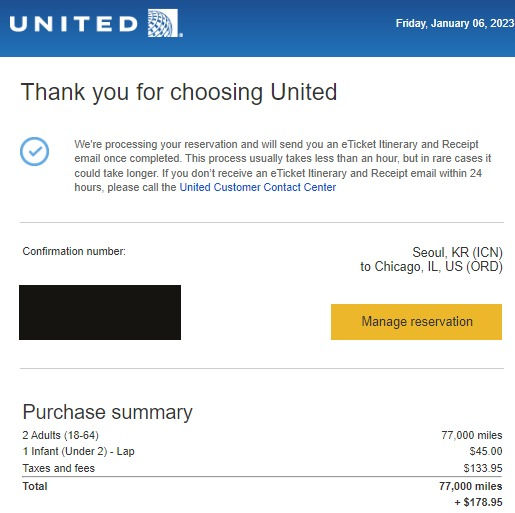

We also have the United Explorer card which gives you miles instead of points that you can use to purchase airfares. In addition to the miles, I appreciate the extra perks that this card gives you with extra checked bags now that I have much more items for the baby. Other perks that this credit cards provide you are lounge passes, early boarding, travel protection, and waived foreign currency fees.

We are going to Asia in the upcoming Spring and with the points that we have earned, we are able to fly for three hundred dollars instead of the three thousand dollars that it would have cost us.

We originally planned to go to the Maldives in 2020 but the pandemic caused our trip to be canceled and we instead used it at the Waldorf Astoria in Los Angeles.

In between our big trips, we take smaller local, budget-friendly trips to save money and accumulate these points. (read: Travel on Budget: Under $500). As we use our points for travel expenses, we can subsidize the cost of our trips without feeling the financial burden of traveling.

Comments